EUR/USD rebounds as risk-on mood saps Dollar, eyes weekly consolidation

- EUR/USD rebounds as risk-on sentiment weakens Dollar after brief two-day DXY rally.

- Softer US jobs data lifts Fed cut bets, with markets repricing easing into year-end.

- ECB officials downplay Euro strength, saying FX moves are already reflected in forecasts.

The Euro found some respite on Friday versus its counterpart the Greenback, which enjoyed a short-live rally of just two days, but erased Thursday’s gains on Friday as depicted by the US Dollar Index (DXY). A risk-on impulse weighed on the Dollar’s safe-haven appeal, while an uneventful ECB monetary policy decision on Thursday, left traders leaning onto market mood. The EUR/USD trades at 1.1817, up 0.34%.

Euro trims losses near 1.1820 as fading Dollar strength and steady ECB messaging steady the pair

The shared currency is poised to end the week with losses, but its seems the EUR/USD is poised to consolidate within the 1.1750-1.1830 area. Economic data in the US revealed that Consumer Sentiment improved in February, yet it failed to boost the US Dollar.

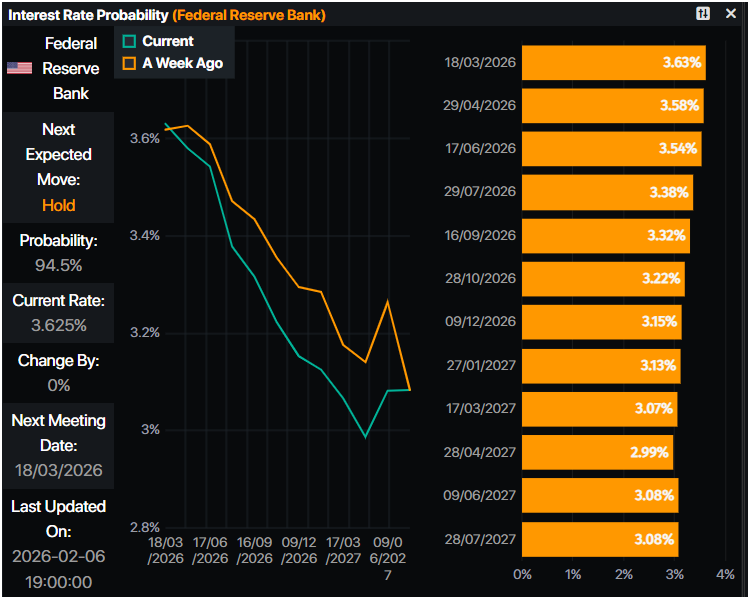

Thursday’s poor jobs data, fueled speculation that the Federal Reserve could cut rates more than twice this year. During Friday's session, money markets priced in 62 basis points of easing, before retreating to 54 bps, according to Prime Market Terminal data.

Meanwhile, Fed speakers crossed the wires with Raphael Bostic being hawkish, Mary Daly striking a neutral tone, while the Vice Chair Philip Jefferson’s, revealed that a stable labor market reduces inflation risks.

Across the pond, the docket was light, yet Industrial Production figures in Germany were worse than expected in December. In the meantime, European Central Bank (ECB) policymakers crossed the wires, but they repeated some of ECB’s President Lagarde’s speech, in which she pointed out that they’re not worried about the volaitity in the EUR/USD, particularly the strength of the Euro. In fact she said that since the summer, the Euro “it has fluctuated within a range…” and that the ECB “concluded that the impact of the exchange rate appreciation since last year is incorporated in our baseline.”

Next week, the calendar will be busy in both sides of the Atlantic, dominated by ECB and Fed speeches. However, the main event would be the Nonfarm Payrolls report for January, Retail Sales and the Consumer Price Index (CPI), both in the US.

Daily market movers: Euro shrugs-off Fed officials comments, rise

- Atlanta’s Fed Raphael Bostic said that it's important to keep interest rates at a level that restricts economic activity and returns inflation to 2%.

- San Francisco Fed President Mary Daly said policymakers must balance both sides of the Fed’s dual mandate. Meanwhile, the Fed’s Vice Chair Philip Jefferson said that he is “cautiously optimistic” about the economy, adding that current monetary policy is “well positioned” to deal with what likely lies ahead.

- Falling job openings, an increase in layoffs highlighted by the Challenger report, and a surge in Jobless Claims have reinforced expectations that the Federal Reserve will begin cutting interest rates in 2026.

- At the same time, the University of Michigan’s Consumer Sentiment index for February improved to 57.3 from 56.4, topping forecasts of 55. One-year inflation expectations declined to 3.5% from 4.0%, while the five-year outlook edged up slightly to 3.4% from 3.3%.

- German industrial production contracted sharply in December, falling 1.9% month-on-month, according to data released by the federal statistics office on Friday. The decline was far steeper than the 0.3% drop anticipated by economists.

Technical analysis: EUR/USD to remain range-bound within 1.1750-1.1830

The technical picture shows the EUR/USD is neutral to downward biased, after registering successive series of lower highs and lower lows, but steadily. Selling momentum is fading as depicted in the Relative Strength index (RSI).

For a bullish continuation, buyers must reclaim the February 4 daily high at 1.1837. A breach of the latter will expose 1.1900. On the other hand, if the EUR/USD pair tumbles below the January 20 high turned support at 1.1769, further losses lie ahead. The next key support is 1.1700 but once conquered, the Euro’s fall could extend to 1.1600.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.